When it comes to travel rewards, airline and hotel loyalty programs often steal the spotlight.

But what about fixed-value points programs?

These lesser-known points programs might not promise flashy First Class redemptions or overwater villas, but they offer consistent value and simplicity that appeal to many travellers.

For those looking to save on travel expenses without diving into the complexities of loyalty programs, fixed-value points programs can be a powerful tool.

In this guide, we’ll explore fixed-value points programs in Canada and how you can make the most of them.

What Are Fixed-Value Points Programs?

Fixed-value points programs are exactly what they sound like: the points you earn have a set redemption value when redeemed. Unlike programs like Aeroplan or American Airlines AAdvantage, where points values can vary based on redemption choices, fixed-value points typically deliver consistent value – say, 1 cent per point.

While the main benefit of this straightforward system is the ease of redeeming points at a guaranteed value, programs like RBC Avion and CIBC Aventura can often exceed 1 cent per point–if you’re willing to put in a little extra effort to understand how they work.

Let’s compare two approaches to redeeming Scene+ points, a fixed-value points program, and Aeroplan points for an Air Canada flight from Toronto (YYZ) to St. John’s (YYT) in Economy Standard fare.

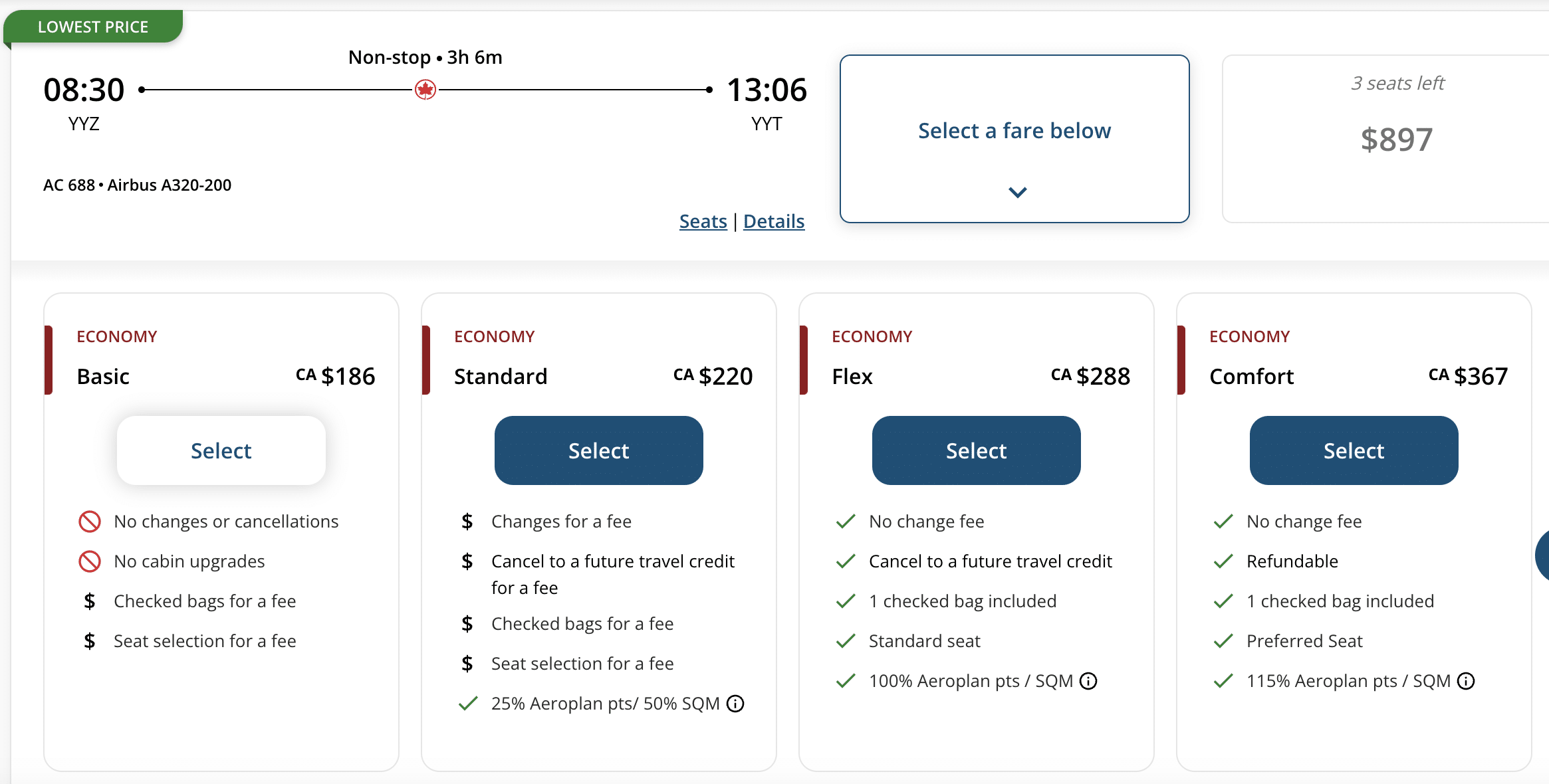

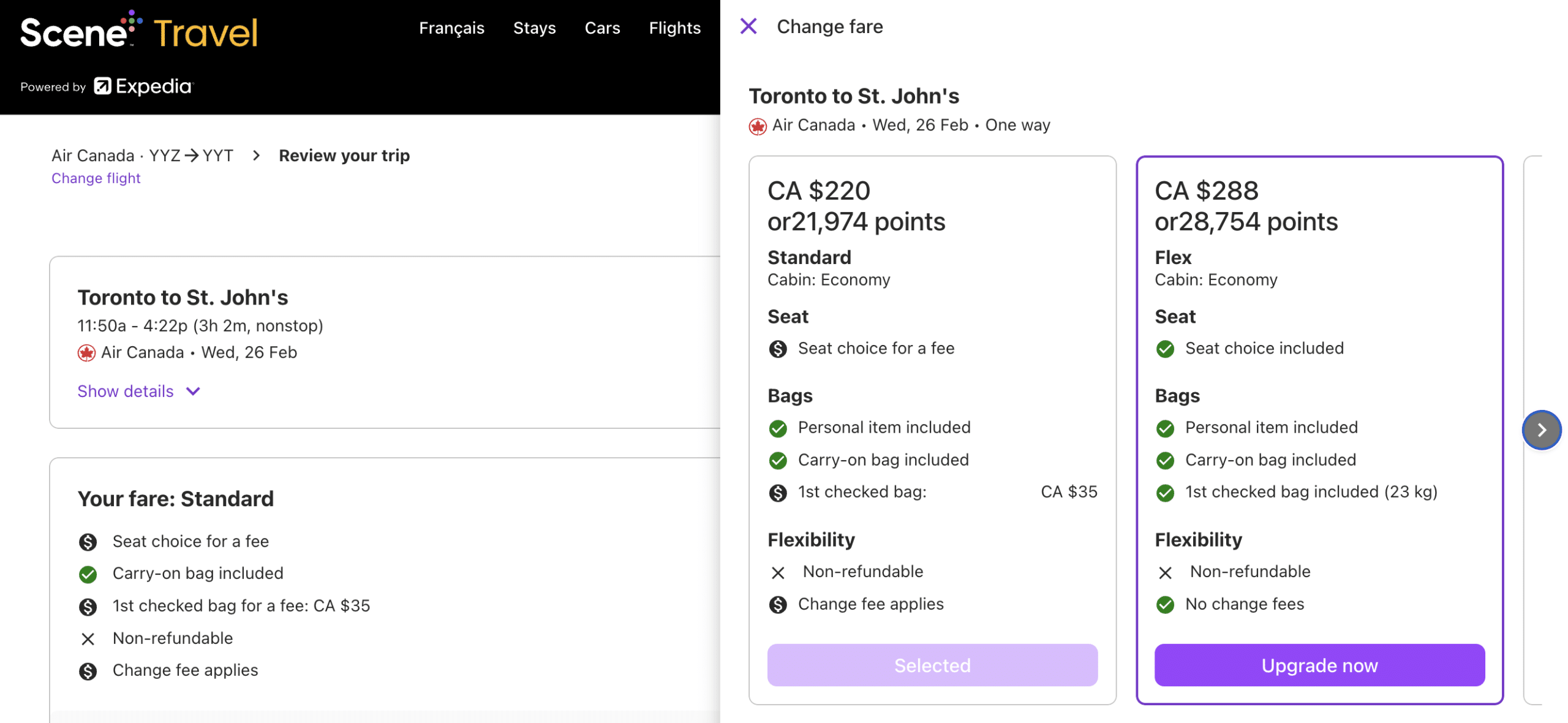

On Air Canada’s website, an Economy Standard flight for this route is priced at $219.74 (all figures CAD)

The exact same flight is available through the Scene+ travel portal for the same price at $219.74, with the option to redeem 21,974 Scene+ points — equivalent to 1 cent per point.

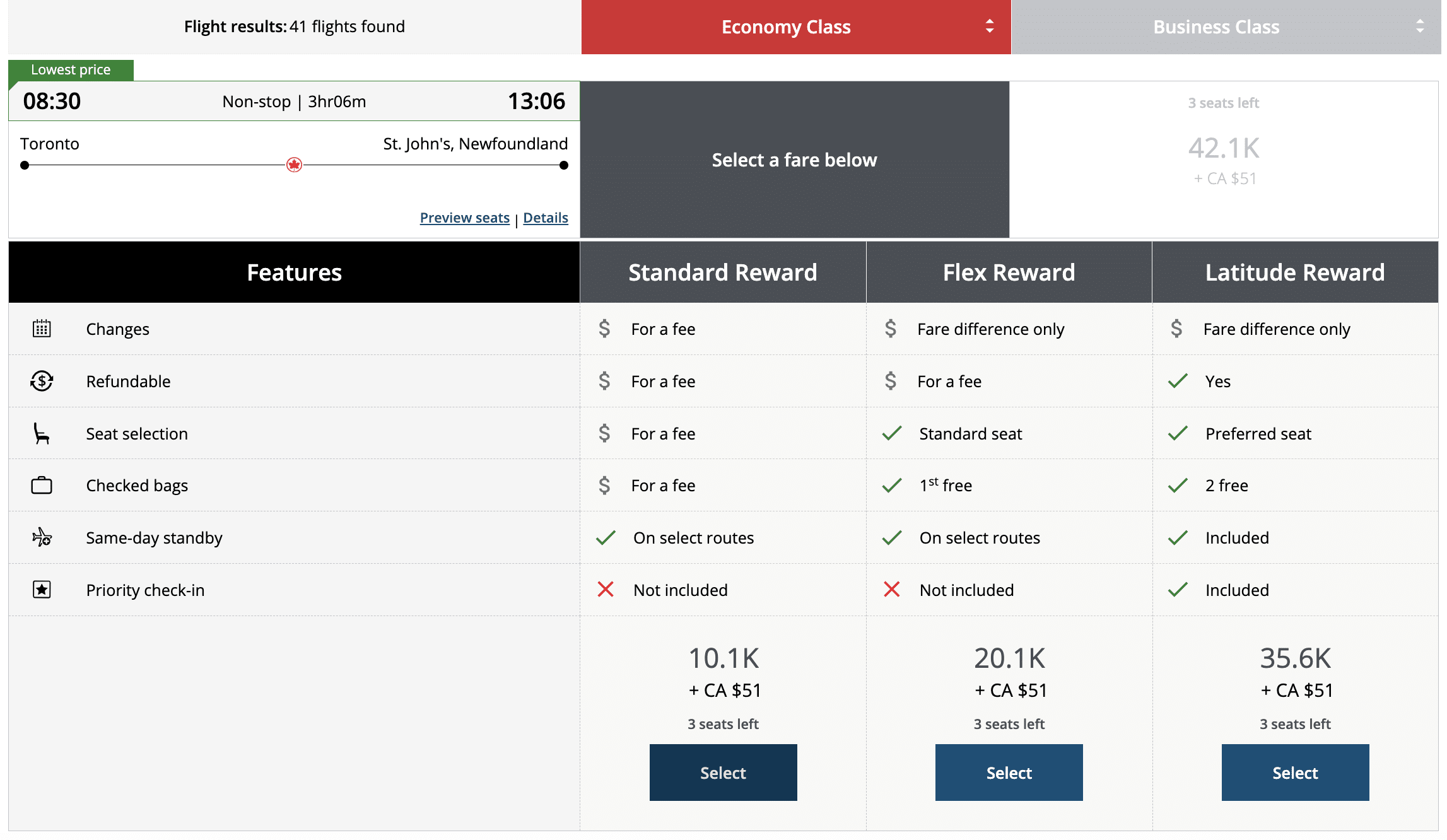

Now let’s examine the same flight using Aeroplan points. This flight can be booked for 10,100 Aeroplan points plus $51 in taxes and fees. This redemption yields a value of 1.67 cents per point, offering better value than redeeming Scene+ points.

However, using Aeroplan points often requires more knowledge about fare rules, baggage requirements, and maximizing redemption value. Without a decent understanding of the Aeroplan program, it’s possible to redeem points at a rate lower than 1 cent per point, which diminishes their value.

On the other hand, Scene+ points provide a hassle-free experience for someone new to points programs, with a guaranteed redemption rate of 1 cent per point. While this fixed value might not offer the aspirational redemptions that appeal to experienced travellers, it also protects beginners from accidentally redeeming their points at poor value.

In Canada, some of the most notable fixed-value programs include:

- AIR MILES®

- BMO Rewards™

- CIBC Aventura Points

- MBNA Rewards

- National Bank À la carte Rewards

- Scotiabank Scene+

- TD Rewards Points

While transferable points currencies like American Express Membership Rewards and RBC Avion can also be redeemed at fixed values, you can often unlock greater value by transferring them to airline and hotel partners, as shown in the example above.

We recommend saving those for big expenses like flights and luxury hotels, and fixed-value points currencies for other travel expenses like transportation and tour packages.

That said, some fixed-value programs also offer flight redemption charts that unlock higher value, such as the CIBC Aventura Flight Rewards Chart, RBC Avion Flight Redemption Schedule, and American Express Fixed Points Travel Program. So it’s worth exploring these options for maximizing your points.

Which Fixed-Value Points Programs Are the Best?

With so many fixed-value points programs available in Canada, it can be quite tricky to point out which one is the best for your travel needs. Below, we’ll break down the pros, cons, and the top credit cards for earning points with some of the most popular programs, helping you choose the right fit for your goals.

AIR MILES®

- Pros: Excellent for experience, including Disneyland bookings

- Cons: Limited flight options and hotel footprints on the dedicated travel portal

- Redemption value on travel: 10.53 cents per Mile (95 Miles = $10)

- Best credit card to earn: BMO AIR MILES®† World Elite®*Mastercard®*

BMO Rewards

- Pros: Flexible redemption options for travel and statement credits

- Cons: Lower redemption rate than other programs

- Redemption value on travel: 0.67 cents per point

- Best credit card to earn: BMO eclipse Visa Infinite Privilege* Card

CIBC Aventura Points

- Pros: Potential outsized value with the CIBC Aventura Airline Reward Charts

- Cons: High value redemptions require a thorough understanding of the program

- Redemption value on travel: 1 cent per point (up to 2 cents per point through CIBC Aventura Airlines Chart)

- Best credit card to earn: CIBC Aventura® Visa Infinite Privilege* Card

MBNA Rewards

- Pros: Easy to earn

- Cons: Limited flight options and hotel foot prints on the dedicated travel portal

- Redemption value on travel: 1 cent per point

- Best credit card to earn:MBNA Rewards World Elite® Mastercard®

National Bank À la carte Rewards

- Pros: Easy to earn, great

- Cons: Limited options and availability on the dedicated travel portal

- Redemption value on travel: 1 cent per point

- Best credit card to earn: National Bank® World Elite® Mastercard®

Scotiabank Scene+

- Pros: Easy to earn, easy to redeem

- Cons: Limited premium redemption options

- Redemption value on travel: 1 cent per point

- Best credit card to earn: Scotiabank Gold American Express® Card

TD Rewards Points

- Pros: Various ways to redeem including Amazon.ca purchases

- Cons: Limited to Expedia4TD for maximum value

- Redemption value on travel: 0.5. cents per point through Expedia® for TD, 0.4 cents per point through Book Any Way travel

- Best credit card to earn: TD First Class Travel® Visa Infinite* Card

In our opinion, Scotiabank Scene+ stands out as one of the best fixed-value points programs. It offers a generous earning rate of 5–6x points on everyday purchases like groceries and dining with the Scotiabank Gold American Express® Card, making it easy to accumulate points quickly. But what truly makes this card compelling is the ease of redemption.

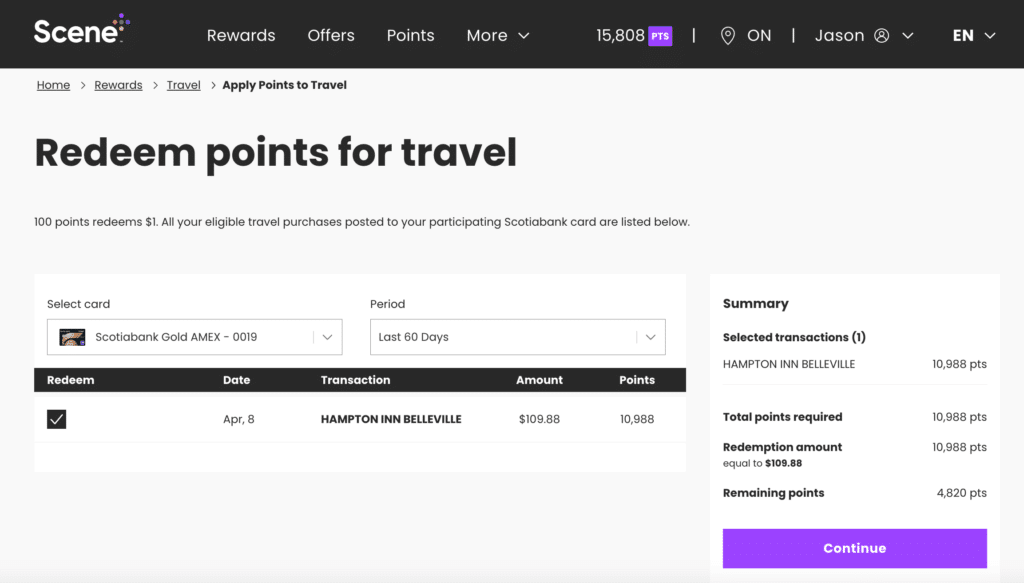

Unlike other programs where it requires you to book travel through their dedicated portal to maximize redemption value, this is not the case for Scene+ points. While Scene+ does have its own travel portal, you’re not locked into using it.

Instead, you can simply charge your travel purchases to your Scene+ points-earning card and apply points toward that purchase afterward.

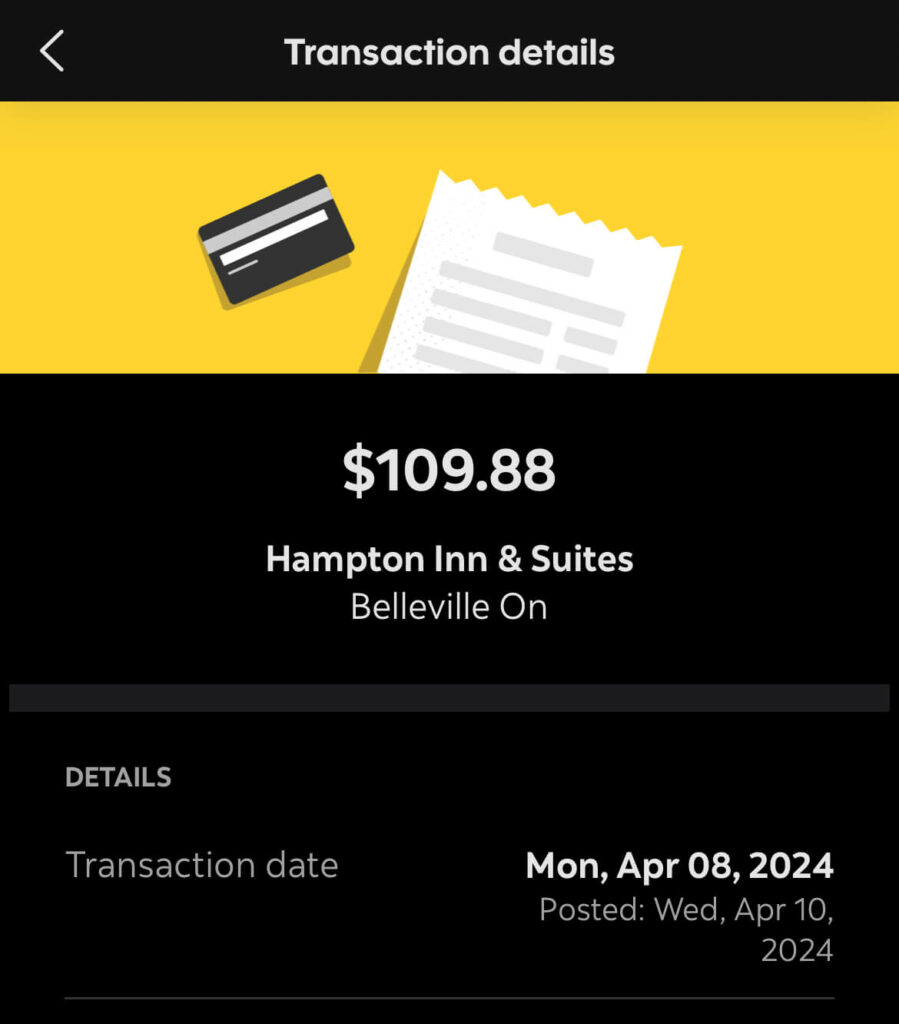

For example, you can make a hotel booking with a Scotiabank Gold American Express® Card.

Once the transaction is posted, you can simply head over to the Scene+ portal to apply points towards the purchase.

Plus, the points can even be applied towards other travel related expenses like transportation and excursions, making it very stretchable.

For these reasons, the Scene+ program is a truly compelling choice for many travellers regardless of their expertise in the points travel world.

Scotiabank Gold American Express® Card

How to Leverage Fixed-Value Points Programs

Other travel expenses

While loyalty programs shine for flights and hotels, fixed-value points are perfect for covering costs like:

- Independent hotels not linked to any hotel loyalty programs

- Tour guides, airport pickups, and excursions

- Cruises, car rentals, and short-term rentals

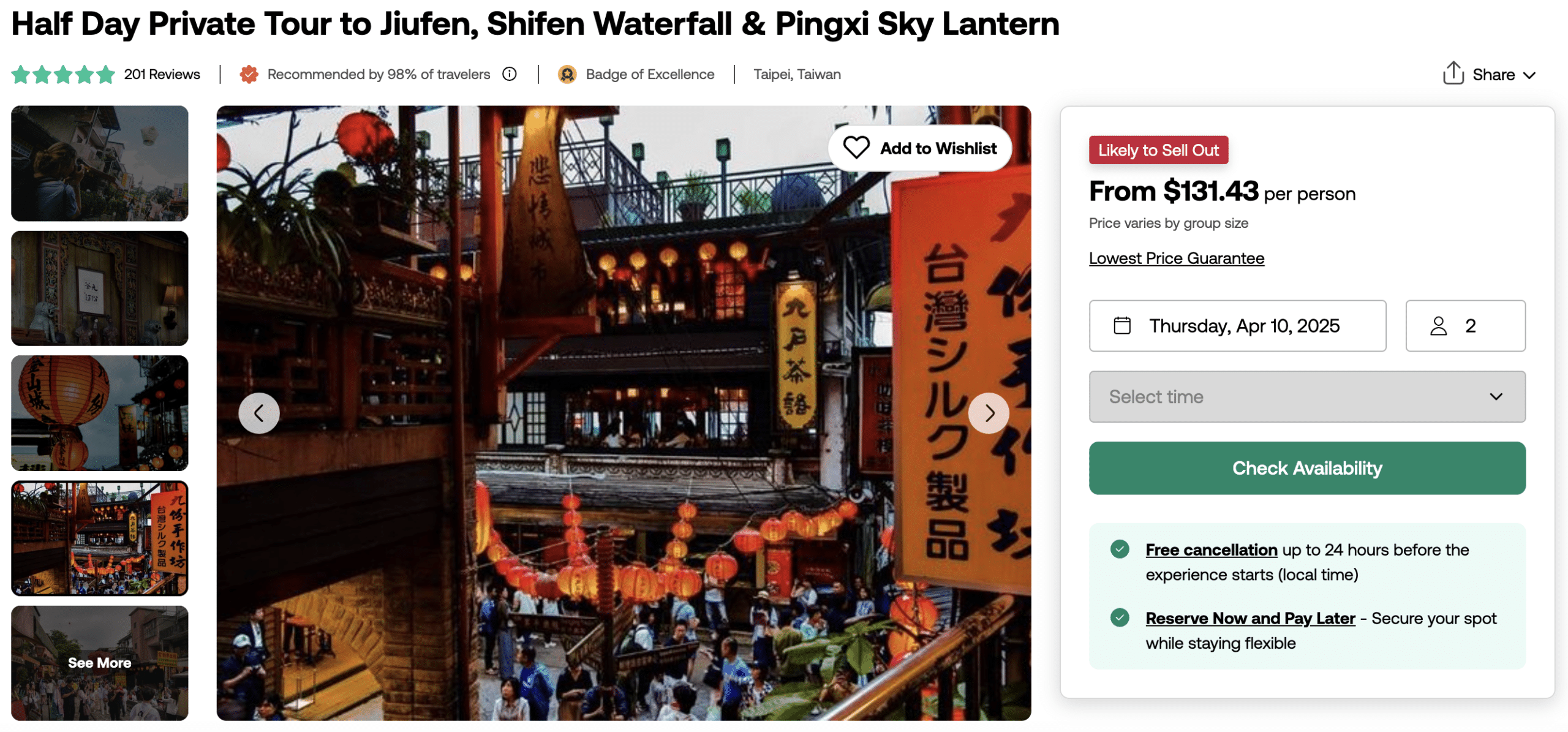

For example, if you’re travelling in a city with tight time but want to fit in all the attractions to your schedule, you can consider booking a guided tour package on platforms like Viator and apply Scene+ points towards the purchase.

Positioning flights

Advanced points travellers often book positioning flights to access better award availability or specific aircrafts that operate only in major hubs. Fixed-value points are an excellent option for these short flights. For example, CIBC Aventura points can unlock significant savings when used with their Airline Rewards Chart.

Let’s say you’re a Torontonian looking to experience Lufthansa First Class. This luxurious cabin is only available on select aircraft departing from major U.S. hub airports in North America. In this case, you’d need to book a positioning flight to Newark to begin your First Class cabin journey.

While short, these flights can often become unexpectedly expensive, especially when demand is high. This is where CIBC Aventura Points come in handy, allowing you to redeem 10,000–20,000 points for a base fare of up to $400. This redemption can yield a value of up to 2 cents per point, making it a strategic and cost-effective way to cover positioning flights.

Keeping it simple

Not everyone has the time or interest to master the complexities of loyalty programs. Fixed-value points programs are a fantastic option for travellers who simply want to minimize out-of-pocket expenses, rather than trying to maximize the points to go on aspirational trips.

With cards like the Scotiabank Gold American Express®, you can rack up points quickly through everyday spending. For example, spending $500 monthly on groceries, gas, and dining could earn you enough Scene+ points in a year to cover up to $600 in any kind of travel expenses.

However, if you have the desire to learn the ins and outs of loyalty programs, we highly encourage diving into frequent flyer programs like Aeroplan, where the potential for outsized value on premium travel experiences is unmatched.

Conclusion

Fixed-value points programs may not have the glamour of premium cabins or luxury hotels, but they’re an excellent tool for saving money on travel without too much effort. Whether you’re offsetting smaller expenses, booking positioning flights or tour guides, these programs have a place in any traveller’s toolkit.

If you’re new to the world of points travel or looking to take your strategies to the next level, consider joining our membership program. Gain access to exclusive resources, expert tips, and a supportive community to help you maximize your points and unlock incredible travel opportunities.

Become a member today and start turning your travel dreams into reality!

English (US) ·

English (US) ·