Carrying a thick stack of cash or scouring the streets for a obscure currency exchange booth is the kind of travel tip you’d expect to find in a history book.

These days, smart travellers can skip the hassle and the terrible rates by using prepaid cards that waive foreign transaction fees and work seamlessly at ATMs abroad.

Even better, these cards help Canadians dodge a common but lesser-known trap: double currency conversion.

When exchanging Canadian dollars into a non-USD currency like Korean won or Mexican pesos, many banks and booths convert your funds to USD first, then to the destination currency, charging you a markup at both steps.

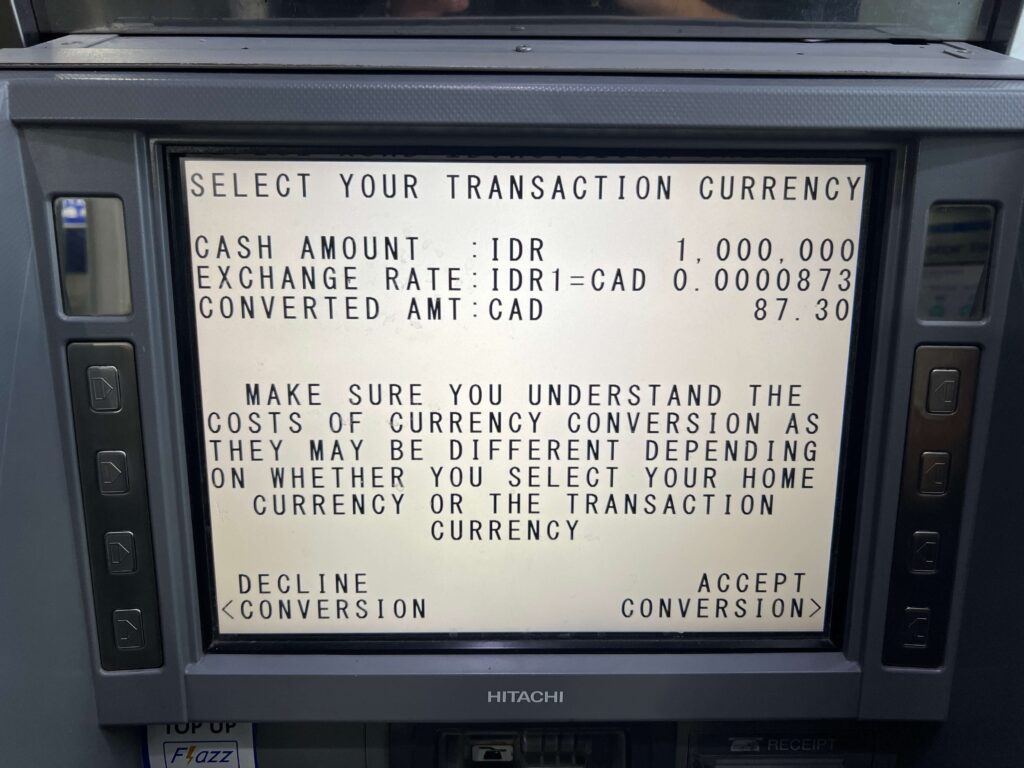

And when withdrawing from an ATM, there’s one more trick to watch out for: Dynamic Currency Conversion (DCC). It quietly inflates the exchange rate when you choose to be charged in your home currency instead of the local one.

Here’s what that trap looks like in real life:

Always decline the dynamic currency conversion prompt.

Always decline the dynamic currency conversion prompt.In this example, the ATM offers to convert 1,000,000 IDR at a rate of 0.0000873, resulting in a charge of $87.30 CAD. But at the time, the mid-market rate was closer to 0.000084—about $84 CAD. That’s a $3+ difference for no reason at all.

Before we dive into the best prepaid cards for travel, let’s take a quick look at how they work and why they’re such a useful tool for managing your money abroad.

What Is a Prepaid Credit Card?

At their core, prepaid credit cards work like a hybrid between a debit card and a credit card. You load funds onto the card in advance, usually via Interac e-Transfer, debit card, bill payment, or direct deposit, and then spend from that balance.

Unlike a traditional credit card, you’re not borrowing money. And unlike most chequing accounts, there are typically any monthly fees or minimum balance requirements.

Better yet, getting one doesn’t involve a hard credit check (as long as you opt out of the overdraft feature), and you won’t accidentally rack up interest charges, since you’re only spending what you’ve already loaded.

Prepaid cards are still part of the Visa or Mastercard network, which means they’re accepted almost anywhere a regular credit card is—both online and in person.

That makes them especially handy for travel, where you might need a card for hotel holds, online bookings, or even just tap payments abroad.

They’re also a great option for students or newcomers to Canada who don’t yet have access to traditional credit. While some hotels or car rental companies may insist on a full credit card, many will accept a prepaid card if it has enough balance to cover the deposit—making it a practical workaround in situations where you’d otherwise be stuck.

And while many Canadians use prepaid cards as a budgeting tool (thanks to sleek apps and instant transaction tracking), they also serve a very specific purpose for travellers: they let you withdraw cash at foreign ATMs without triggering the usual cash advance fees or foreign exchange markups that credit cards love to sneak in.

Compare the Best Prepaid Cards for Canadian Travellers

With so many options available, choosing the right prepaid card depends on your travel habits, spending style, and need for simplicity or flexibility.

Here’s a side-by-side look at the top no-FX-fee prepaid cards for Canadians in 2025, highlighting their strengths, limitations, and ideal use cases.

Wealthsimple Prepaid Mastercard: Sleek, Simple, and No FX Fees

If you’re looking for the most well-rounded prepaid card to take on your travels, the Wealthsimple Prepaid Mastercard is the one to beat.

It hits all the right notes: no fees of any kind, no foreign transaction fees, and no ATM withdrawal fees—a rare trifecta that makes it a standout for Canadians heading abroad.

- 1% cash back on every purchase, which you can choose to direct into cash, stocks, or crypto holdings (note that the latter two options have tax implications if they rise in value, so cash back may be preferable for a general user)

- No foreign exchange fees – a rare sight in the Canadian market

- No ATM withdrawal fees – other than fees imposed by the ATM operator (many ATMs worldwide don’t charge a fee); Wealthsimple also reimburses up to $5 per transaction for domestic ATM fees in Canada (credited within 3–4 business days)

- Generous ATM withdrawal limits – up to $3,000 per day and $10,000 per week

- No monthly or annual fees

- Send/receive Interac e-Transfers with no fees (fast and up to $5,000 per transfer)

- Loads easily via Interac e-Transfer, debit card, external bank transfer, or direct deposit

- Funds are CDIC insured up to $100,000

- Fully compatible with Apple Pay and Google Pay

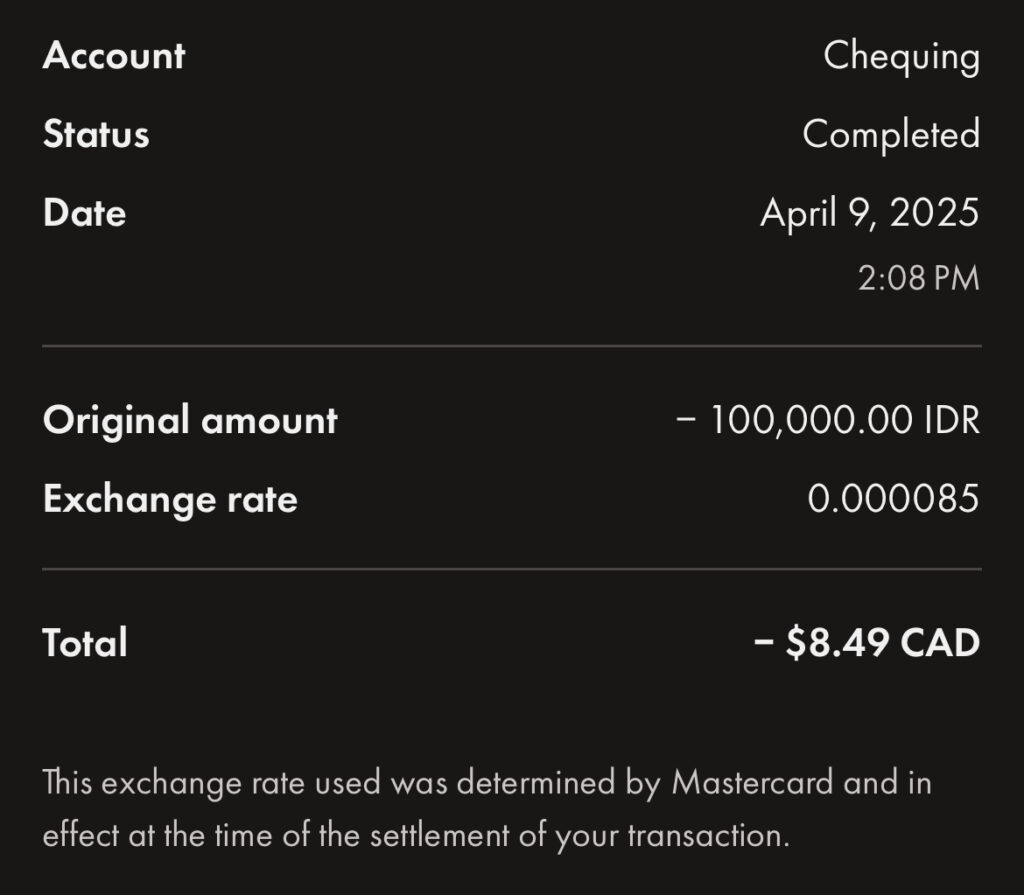

You don’t just have to take my word for it, here’s a real-world example.

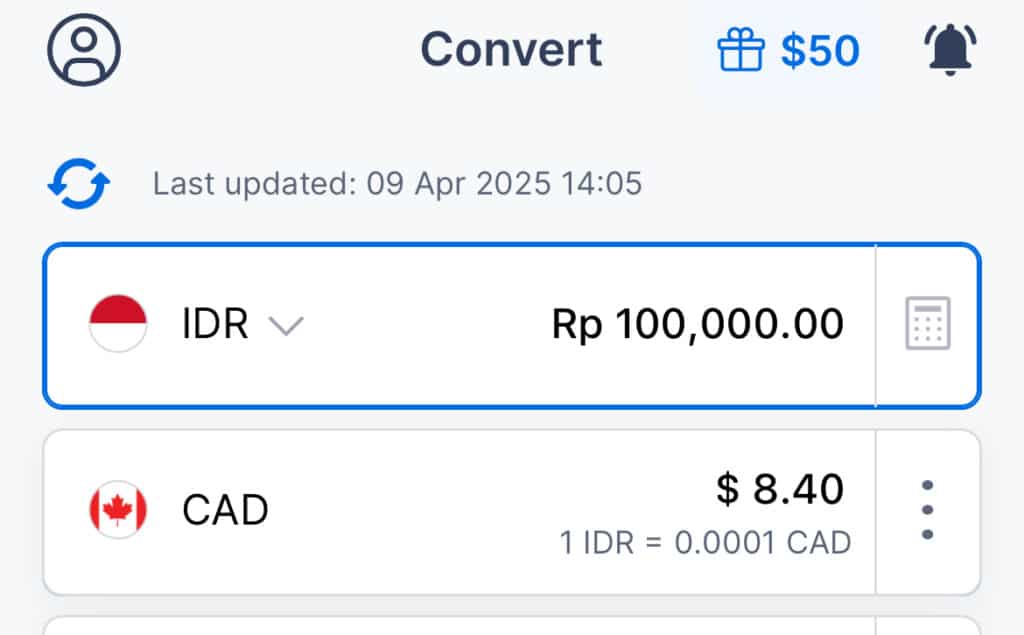

On April 9, 2025, I withdrew 100,000 Indonesian Rupiah (IDR) using my Wealthsimple Prepaid Mastercard. The card charged me $8.49 CAD, while the mid-market rate at the time (according to XE Currency) would have converted the same amount to $8.40 CAD.

The Mastercard exchange rate used was 0.000085, while the mid-market rate was 0.000084. In other words, the rate I received was essentially at spot, with no added FX markup or withdrawal fee from Wealthsimple.

This confirms that you’re getting very competitive conversion rates when using Wealthsimple abroad, and it’s a great example of why this card stands out for international use.

The app is also sleek and beginner-friendly, and the physical card comes with a clean black-and-gold design that feels more premium than you’d expect from a prepaid product.

Personally, I’m a big fan of what the Wealthsimple Prepaid Mastercard currently offers. It feels almost too good to be true in today’s market, and I really hope this isn’t just a customer acquisition strategy that leads to nerfs down the road.

If it stays this strong, it’ll continue to be one of the best prepaid cards Canadians can carry while travelling.

Wealthsimple also offers additional benefits based on your assets under management, with three tiers: Core, Premium, and Generation. You only need $1 in assets to qualify for the Core tier, which already includes all the key features listed above.

Premium and Generation tiers, unlocked with $100,000 and $500,000 in assets respectively, offer higher interest rates, priority service, and added partner perks like airport lounge passes, but you don’t need these to benefit from the travel-friendly core features.

One thing to keep in mind is that Wealthsimple blocks transactions and ATM withdrawals in the following countries due to sanctions or internal policy:

Afghanistan, Bangladesh, Belarus, Central African Republic, Congo, Cuba, Democratic Republic of Congo, Eritrea, Ethiopia, Guinea-Bissau, Haiti, Iran, Iraq, Kosovo, Liberia, Libya, Mali, Myanmar, North Korea, Russia, São Tomé and Príncipe, Sierra Leone, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, and Yemen.

Be sure to check the official list before making travel plans.

With generous limits, a sleek app, and zero fees even at the base tier, the Wealthsimple Prepaid Mastercard earns its spot as my top recommendation for prepaid travel cards in Canada.

EQ Bank Card: Fee-Free Functionality with a Few Frictions

The EQ Bank Card is a practical and dependable prepaid option for Canadians who want to avoid foreign transaction fees without giving up the full functionality of a traditional bank account.

While it may not be the flashiest card out there, it offers a compelling mix of features—especially if you value flexibility, security, and interest on your balance.

Here’s what makes the EQ Bank Card a solid travel companion:

- No foreign transaction fees

- No monthly or annual fees

- No EQ-imposed ATM withdrawal fees (only operator fees may apply)

- Automatic reimbursement of domestic ATM fees (up to any amount)

- Earn interest on your balance – currently 1.25%, with promotions of up to 4% when you set up direct deposit of $2,000+ per month

- 0.5% cash back on purchases

- Loads easily from your EQ Bank savings account (which supports Interac e-Transfer, bill payments, and direct deposit)

- Fully compatible with Apple Pay and Google Pay

- Includes full bank account features, including cheque deposits, bill pay, and more

A key difference with EQ Bank is how it handles your funds: your main balance sits in a high-interest savings account, and you must manually transfer money to your card balance in order to spend or withdraw it.

While this adds a layer of control and acts as a helpful safety buffer if your card is lost or stolen, it can feel inconvenient if you’re trying to make a quick purchase or grab cash on the fly.

Another key limitation to be aware of: the EQ Bank Card does not support Mastercard 3D Secure transactions. As more merchants adopt this security protocol, some online purchases may be automatically declined. If you frequently shop online, this could become a recurring inconvenience.

Additionally, the EQ Bank app often feels slow and dated. While functional, the app feels noticeably slower compared to more modern fintech platforms.

That said, EQ Bank is a Schedule I Canadian bank, meaning your deposits are CDIC insured up to $100,000, offering peace of mind while travelling or storing higher balances.

If you don’t mind the manual transfers and occasional app lag, the EQ Bank Card delivers meaningful value for Canadian travellers, particularly those who appreciate a no-fee setup and interest-bearing balance.

Bottom line: Wealthsimple wins for pure convenience, while EQ Bank wins for old-school control and security.

Wise Card: A Niche but Powerful Backup for Travel

Thirdly, we have the Wise Card, which isn’t quite as strong as the former two options—but still plays an important role for travellers who need flexibility.

Processed through Visa, the Wise Card can serve as a great backup, especially in situations where a merchant or ATM only accepts Visa rather than Mastercard.

It uses the real mid-market exchange rate for currency conversions, a much better deal compared to the typical 2.5% foreign transaction fee charged by most Canadian banks.

Better yet, Wise displays all fees transparently and even compares their rates against traditional banks in real time. I truly appreciate this approach and honestly wish more financial institutions would adopt this level of transparency as a standard feature.

Before the launch of the Wise Card, Wise primarily focused on helping consumers exchange currencies at better rates than large banks, and this legacy shows.

It offers a unique feature not found on most other prepaid cards: the ability to hold, spend, and send foreign currencies directly to local bank accounts overseas.

This can be a big advantage if you want to convert your money in advance.

For example, if you’re planning a trip to Türkiye and the Turkish Lira is currently undervalued against the Canadian dollar, you can proactively convert your funds to TRY, lock in the rate, and hold onto it until your travels.

Here’s a quick overview of what the Wise Card offers:

- Access to 50+ currencies to hold, convert, and spend

- Real mid-market exchange rates with low transparent conversion fees (~0.35–1%)

- Visa network acceptance worldwide

- Ability to send money directly to foreign bank accounts

- Fully compatibale with Apple Pay and Google Pay

- No hidden fees, with real-time comparisons against banks

However, it’s not all smooth sailing.

While Wise technically advertises free ATM withdrawals, the reality is more restrictive: you’re limited to $350 across two withdrawals per month, after which fees kick in.

Beyond that, Wise charges a $1.50 flat fee + 1.75% of the withdrawal amount. A fee structure that feels unusually punitive compared to the other prepaid cards we’ve covered.

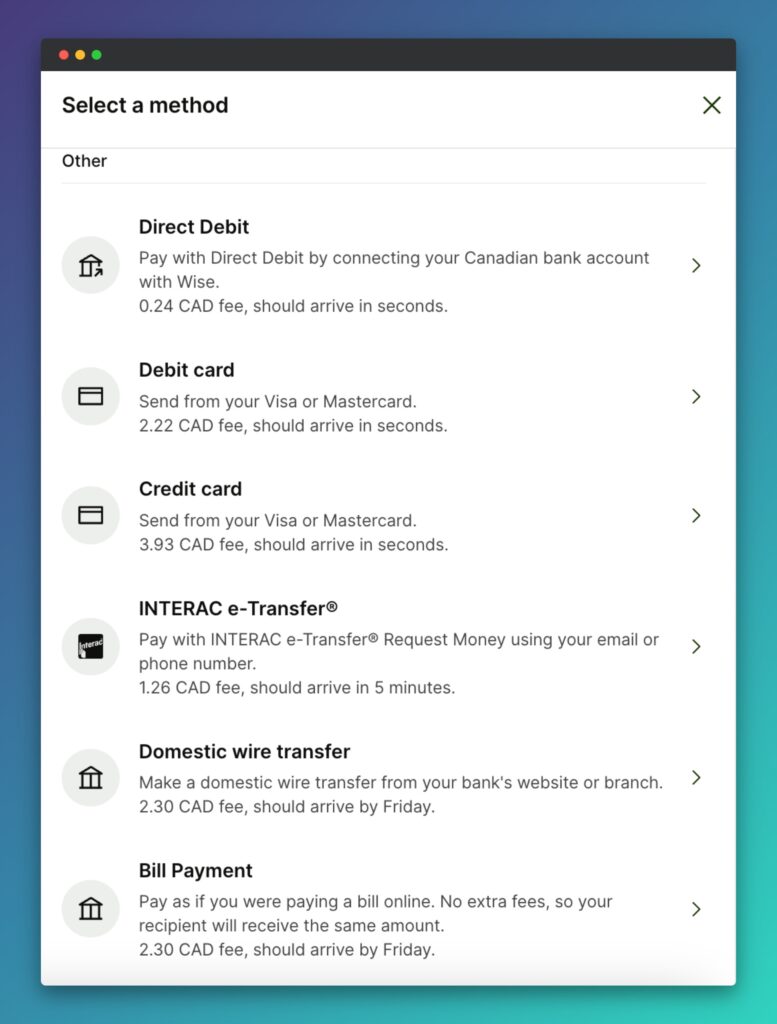

Another critical point: adding funds to your Wise account can also be deceptively tricky. When topping up, you won’t find an obvious free loading option.

wise load fees

wise load feesHowever, there’s a hidden method: by setting up auto-deposit using your Wise login email, you can send an Interac e-Transfer to your Wise account for free. It works perfectly, but Wise doesn’t exactly shout this from the rooftops.

A recurring theme in the world of prepaid cards is that the products, including the Wise Card, are accessed primarily via apps. Wise also has excellent functionality on its desktop site, unlike some of the other options on its app.

Overall, it’s no secret that Wise offers a multitude of functions, but it’s definitely a double-edged sword. While the flexibility and currency control are fantastic for power users, the system is complex enough that the average user might face a steep learning curve to fully maximize all the benefits.

If you’re willing to put in the effort, the Wise Card can be an incredibly handy backup tool to pair with a more straightforward primary prepaid card.

PC Money Account: Now FX-Friendly, But Still Better for Local Use

The PC Money Account has quietly become a more viable option for travellers, thanks to a recent update that removed foreign transaction fees.

While it’s still not as feature-rich as other cards in this list, it earns a place as a solid no-fee backup, particularly if you already shop within the PC Optimum ecosystem.

Issued by PC Financial and powered by the Mastercard network, the card acts as a hybrid prepaid account and chequing alternative, with reward-earning potential and full mobile wallet support.

Here’s what you get with the PC Money Account:

- No monthly or annual fees

- No foreign transaction fees

- $1.50 fee for domestic ATM withdrawals outside PC Financial ATMs

- $3.00 fee for international ATM withdrawals

- Earn 10 PC Optimum points per dollar spent at Loblaw banner stores

- Earn 5 PC Optimum points per dollar spent on all other purchases

- Free Interac e-Transfers

- Apple Pay and Google Pay compatible

While the 1% earn rate at Loblaw stores is attractive, the base 0.5% earn rate elsewhere isn’t particularly competitive compared to some other prepaid or cashback cards. And although foreign transaction fees have been eliminated, the flat ATM fees ($3 internationally) can still add up if you’re withdrawing cash frequently abroad.

That said, there’s another sweetener: PC Financial also occasionally runs bonus points promotions at Loblaw banner stores when you pay with a PC Financial product, including the PC Money Account. These promotions can offer an easy way to boost your Optimum points balance even faster if you regularly shop at affiliated stores.

Thanks to no FX fees, free e-Transfers, and strong grocery integration, the PC Money Account is now much more traveller-friendly than it used to be. It’s still best suited for domestic everyday use, but it can also serve as a handy backup for occasional travel or online spending, especially for those already invested in the PC Optimum program.

Conclusion

Prepaid cards have come a long way from being niche budgeting tools to becoming genuinely useful companions for travellers. Whether you’re looking to dodge foreign transaction fees, withdraw local currency without cash advance charges, or simply avoid the risk of carrying a credit card, there’s a prepaid option that fits the bill.

For most Canadians, the Wealthsimple Prepaid Mastercard stands out as the best all-around choice—it’s simple, fee-free, and rewarding.

EQ Bank adds a layer of control and savings account integration, while Wise offers unmatched flexibility for multi-currency travellers, albeit with a steeper learning curve.

Meanwhile, the PC Money Account has become a surprisingly decent backup card, especially for PC Optimum enthusiasts and domestic shoppers.

Each card has its own strengths and trade-offs, but the key takeaway is this: you no longer need to rely on cash exchanges or credit card fees when travelling. With the right prepaid card (or combo of two), you can keep things secure, simple and cost-effective

English (US) ·

English (US) ·