The Wealthsimple Visa Infinite* Card is Wealthsimple’s first foray into the credit card space, and like most things Wealthsimple touches, it’s designed with simplicity in mind.

While still no welcome bonus and only available via public waitlist, the card still offers unlimited 2% cash back on all purchases, no foreign transaction fees, and a recently added suite of travel insurance benefits, making it a much more well-rounded product than it was at launch.

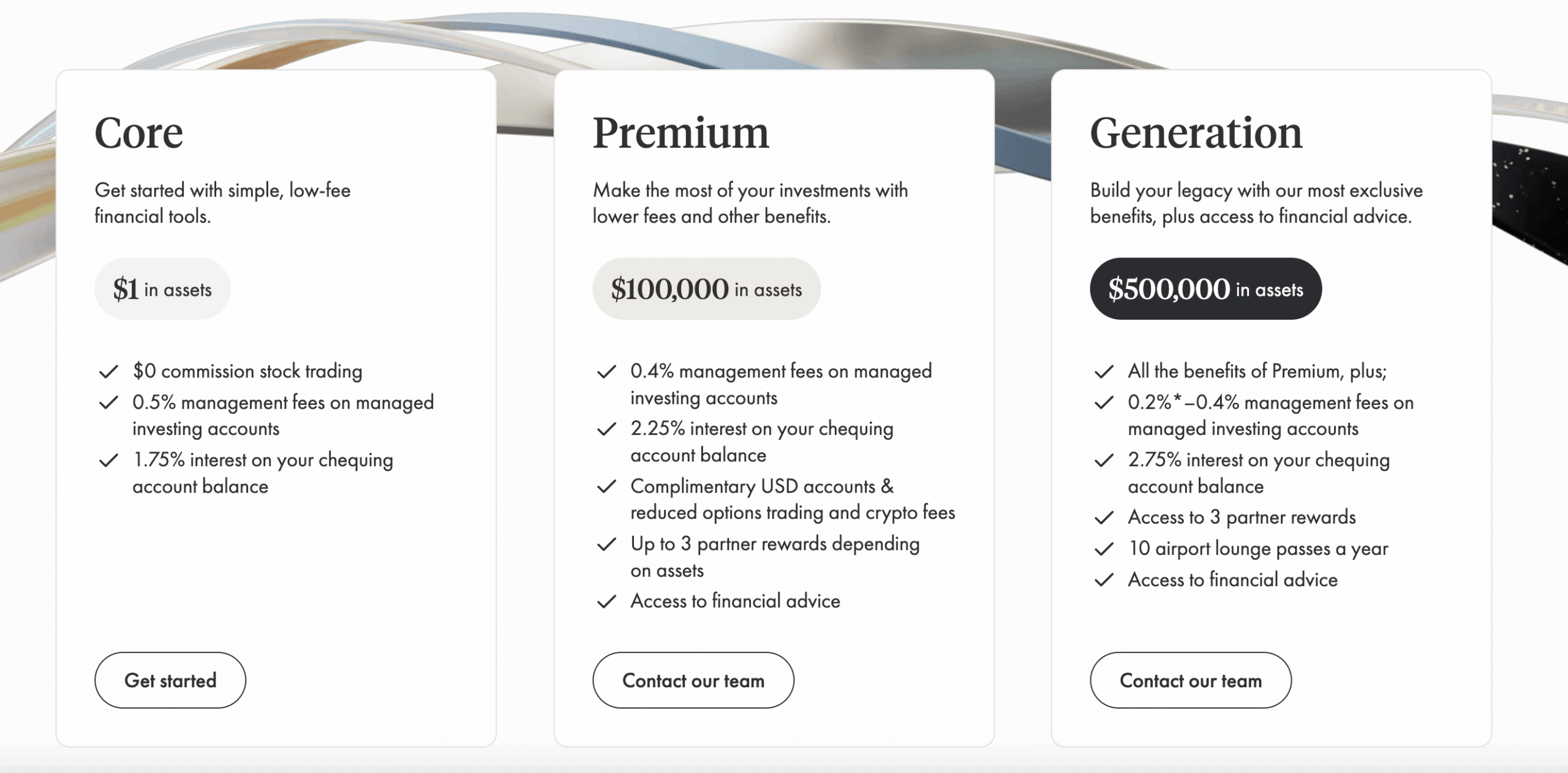

Wealthsimple has also increased the monthly fee to $20, unless you qualify for a waiver by being a Premium or Generation client, or by setting up $4,000/month in direct deposits as a Core client.

Even with these changes, the card still delivers one of the most compelling value propositions in Canada: unlimited 2% cash back on all purchases, with no foreign transaction fees — a rare combination that remains unmatched.

Let’s break down what this card actually offers, and whether it deserves a spot in your wallet.

Wealthsimple has also launched a Visa Infinite Privilege* version of the card, targeting higher-net-worth clients. I’ll be reviewing that card in a separate post soon.

What we love: Unlimited 2% cash back with no caps, no foreign transaction fees

What we’d change: No welcome bonus, limited availability via waitlist, and payments restricted to Wealthsimple Chequing

No Welcome Bonus (For Now)

Unlike most cash back credit cards on the market, the Wealthsimple Visa Infinite* Card currently doesn’t offer any welcome bonus, not even a temporary boost or statement credit.

Of course, it’s still in a limited rollout and only available through a public waitlist for existing Wealthsimple clients, so it’s possible a welcome offer may be introduced later when the card is released to the public.

Still, it’s hard to ignore the missed opportunity here. Most competing cash back cards sweeten the deal for new users.

For example:

- The CIBC Dividend® Visa Infinite* Card offers 10% cash back on your first $2,000 in purchases† , plus a first-year annual fee rebate.

- The TD Cash Back Visa Infinite* Card frequently comes with 10% back on the first $3,500 in eligible categories†, also paired with a first-year fee waiver.

These upfront rewards can easily amount to $200–350 of value in your first few months, and that’s before factoring in the other benefits. By comparison, Wealthsimple charges you $20/month from day one (unless you qualify for a fee waiver), without offering any immediate return. It’s a notable drawback in a competitive market.

Whether this changes in the future remains to be seen, but for now, this card doesn’t bring anything extra to the table for new applicants.

Unlimited 2% Cash Back on Everything, Anywhere

The Wealthsimple Visa Infinite* Card keeps things refreshingly simple: you earn 2% cash back on all purchases†, without any spending caps or categories to track.

This “set-it-and-forget-it” model is rare in Canada. Most cash back credit cards offer elevated earn rates only up to a certain spending threshold, after which the earn rate drops significantly.

To put things in perspective:

- The TD Cash Back Visa Infinite* Card earns 3% on groceries, gas, and recurring bills, but only on the first $15,000 per category each year†. Beyond that, you’re down to a flat 1%.

- The Scotia Momentum® Visa Infinite* Card earns 4% on groceries and recurring bills, and 2% on gas and transit, but only on the first $25,000 in total spend across those categories annually†.

- The CIBC Dividend® Visa Infinite* Card has a combined $20,000 cap across its 4% and 2% bonus categories, and a hard cap of $80,000 in total annual card purchases†. Once you cross that $80,000 threshold, you’ll be earning the base rate of 1% cash back on all eligible purchases until the following calendar year.

By contrast, Wealthsimple’s card has no cap. You’ll earn 2% back whether you spend $500 or $50,000 a year. That’s an edge for anyone who regularly maxes out other cards or just wants a simpler solution without micro-managing bonus categories.

Even better, you can redeem your cash back instantly, as soon as the transaction posts and the rewards are issued. No waiting for monthly statements, minimum thresholds, or statement credits to kick in. It’s straightforward and on your terms.

No Foreign Transaction Fees

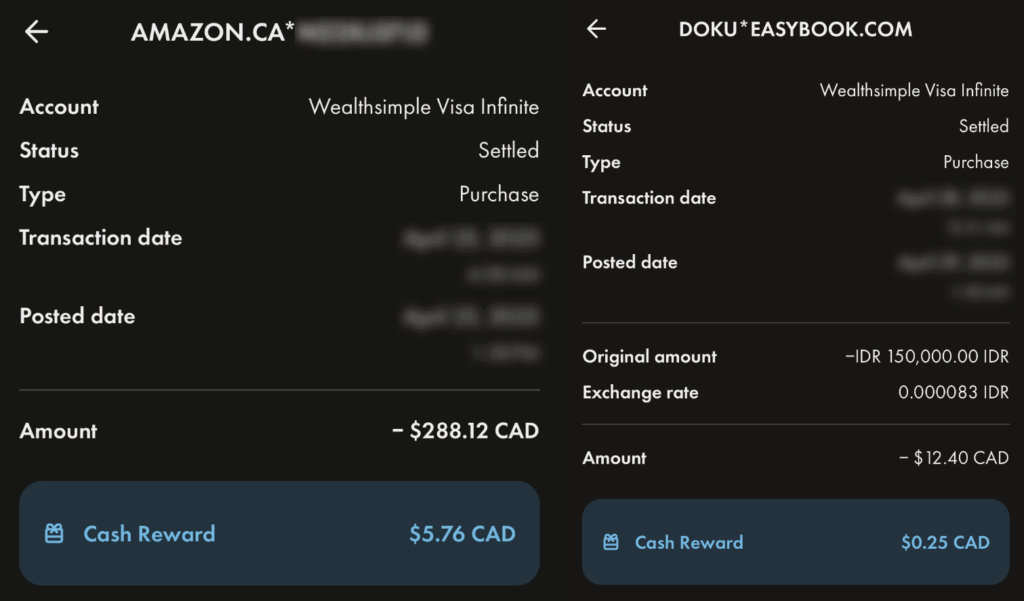

Another major win with the Wealthsimple Visa Infinite* Card is the no foreign transaction fees. Most Canadian credit cards tack on an extra 2.5% fee when you spend in foreign currency — a quiet but costly charge that eats into your rewards.

This makes Wealthsimple’s flat 2% earn rate even more valuable when travelling or shopping online internationally.

For example, a typical cash back card might earn 4% on groceries or dining, but once you factor in the 2.5% FX fee, your net reward drops to around 1.5%, and that’s assuming the purchase even codes correctly as a bonus category.

Wealthsimple’s flat and fee-free 2% is a clear winner here.

Even cards that do waive the FX fee, like the Scotiabank Passport® Visa Infinite* Card, only offer 2x Scene+ points on groceries and dining†. That’s solid, but for all other categories, it drops to just 1x.

By contrast, Wealthsimple earns 2% cash back across the board, whether you’re buying souvenirs, booking tours, or paying for entry to attractions.

It’s a simple, reliable card to use on any trip, no need to remember which card to pull out for which category.

Perks & Visa Infinite Benefits

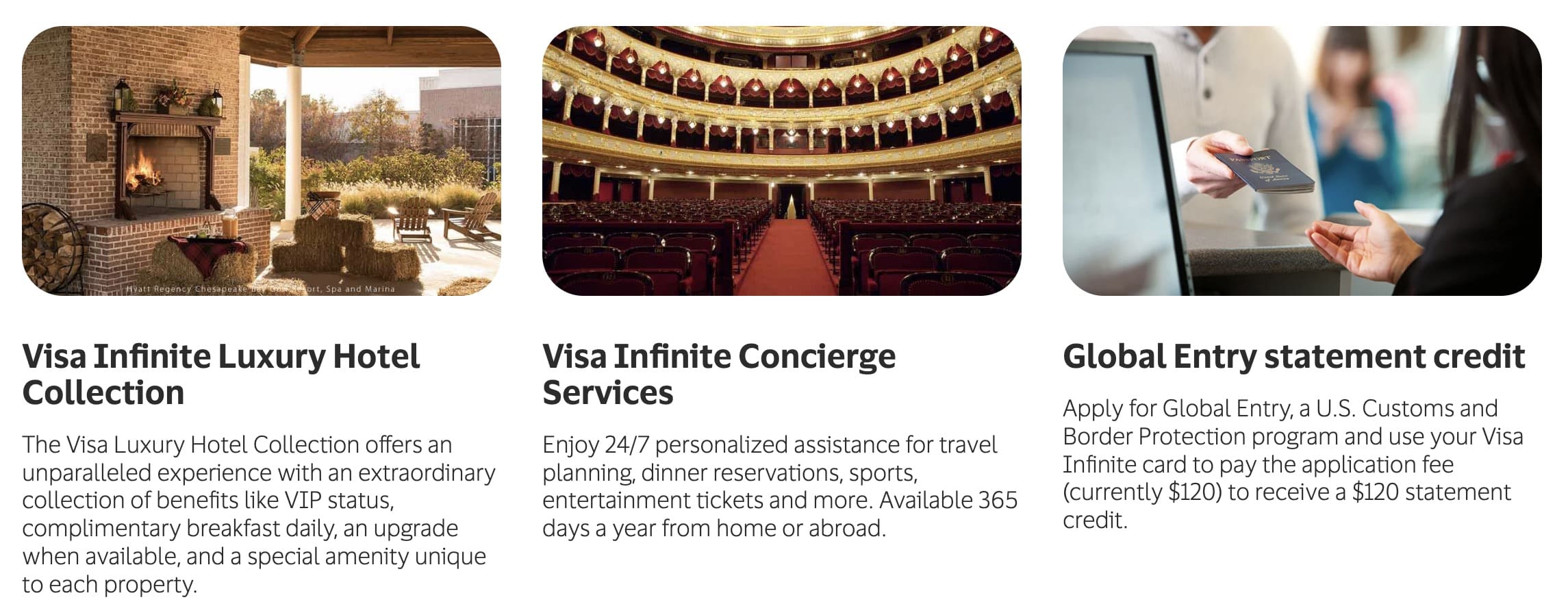

The Wealthsimple Visa Infinite* Card doesn’t come with any flashy perks of its own. No complimentary lounge access, no travel credits, no roadside assistance.

Instead, the card relies solely on the standard Visa Infinite benefits, which include:

- Visa Infinite Concierge

- Visa Infinite Dining and Wine Country programs

- Access to the Visa Infinite Luxury Hotel Collection

These are nice-to-have, but they’re not unique to Wealthsimple and nearly every Visa Infinite card in Canada offers the same suite.

Wealthsimple itself does offer client tier benefits based on the size of your investment portfolio, but those aren’t tied to holding the credit card and don’t enhance the card experience directly.

Insurance Coverage

One of the biggest recent improvements to the Wealthsimple Visa Infinite* Card is the addition of a surprisingly robust insurance package, finally bringing it in line with what you’d expect from a premium credit card.

Here’s what the updated coverage includes:

- Out-of-Province/Out-of-Country Emergency Medical Insurance

Covers eligible cardholders under age 65 for up to $1 million in medical expenses while travelling, for trips up to 15 consecutive days.

Includes hospital and medical expenses, emergency dental (up to $2,000 for accidents), evacuation, return of remains, and up to $1,500 in hotel/meals if you’re hospitalized. - Mobile Device Insurance: Up to $1,000 if your phone is lost, stolen, or accidentally damaged.

- Purchase Security: Covers new items against theft or damage for 90 days after purchase.

- Extended Warranty: Doubles the manufacturer’s warranty up to one additional year.

- Car Rental Collision/Loss Damage Insurance: Covers rentals for up to 48 days (MSRP limit: $65,000).

- Delayed & Lost Baggage Insurance: Up to $1,000 for delayed bags and $1,000 for lost/damaged ones, with a combined cap of $1,250.

- Trip Cancellation & Interruption Insurance: Up to $1,500 per eligible person (maximum $5,000 per trip), if your travel plans change due to a covered reason.

That’s a strong lineup for a flat-rate cash back card, and more than enough to cover the basics for occasional travellers.

Note: Coverage is currently not available to residents of Quebec. Full eligibility criteria and exclusions apply.

Joining the Waitlist & Wealthsimple Requirements

As of December 2025, the Wealthsimple Visa Infinite* Card still remains in a limited release, and while there’s still no public application link, Canadians can join the public waitlist directly through the Wealthsimple app.

If you haven’t registered for the waitlist yet, here’s how to do it:

- Sign in to the Wealthsimple mobile app

- Scroll and tap Add an account

- Choose Open a new account

- Select Credit Card from the account options

- Tap Join the waitlist

- Check the box and tap Next to agree to the soft credit check

- Once you’re on the waitlist, Wealthsimple will send a notification when you’re eligible to apply

Note: If you live in Quebec, you’re still out of luck — the card isn’t available there yet.

That exclusivity might add some allure, but it also means this card isn’t a viable option for most Canadians, at least not yet.

Additionally, you can only pay your card balance using a Wealthsimple Chequing account. Realistically, you likely won’t even receive an invite unless you already have one.

Once the product officially launches, it’s possible that payments from external banks may be allowed. But for now, this looks like a smart strategy to encourage customers to hold more of their cash and assets within the Wealthsimple ecosystem.

The Wealthsimple Visa Infinite* Card comes with a $20 monthly fee*, which can be waived if you’re a Premium or Generation client. Core clients can also have the fee waived by setting up monthly direct deposits of at least $4,000.

On the flip side, the Wealthsimple Cash Mastercard, which is linked to the Wealthsimple Chequing account, is actually a great no-FX-fee prepaid card for withdrawing foreign currency at ATMs abroad.

Wealthsimple recently made it even better by reimbursing ATM withdrawal fees globally — a perk rarely seen in Canada. This makes it an ideal travel companion, especially in countries where ATM fees can be steep, like Thailand, Indonesia, or Mexico.

If you’re already using it for travel or day-to-day purchases, being tied to the Chequing account won’t feel like a barrier, in fact, it might be a bonus.

Other Cards to Consider

The Wealthsimple Visa Infinite* Card stands out for its unlimited 2% cash back and no foreign transaction fees, but it’s not the only option out there, especially if you want broader perks or better travel coverage.

Here are two strong alternatives:

Scotiabank Passport™ Visa Infinite* Card

This card also has no FX fees, but comes with six free airport lounge visits per year, full travel insurance, and earns 2x Scene+ points per dollar spent on groceries, dining, and entertainment.

However, it only earns 1x on everything else, so you may not earn as much overall if your spending is more general.

Scotiabank Passport® Visa Infinite* Card

- Earn 35,000 Scene+ points upon spending $2,000 in the first three months

- Earn an additional 10,000 Scene+ points upon spending $40,000 annually

- Earn 2x Scene+ points on groceries, dining, entertainment, and transit

- Plus, earn 3x Scene+ points on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per year

- Redeem points for a statement credit against any travel expense

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $150

Scotiabank® Gold American Express® Card

Another no-FX-fee card, with up to 6x Scene+ points per dollar spent on groceries, restaurants, and food delivery, plus solid travel insurance.

Just note that Amex acceptance can be hit-or-miss abroad, and non-bonus categories only earn 1x.

Scotiabank Gold American Express® Card

- Earn 30,000 Scene+ points upon spending $2,000 in the first three months

- Plus, earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 5x Scene+ points on groceries, dining, and entertainment

- Also, earn 3x Scene+ points on gas, transit, and select streaming services

- Redeem points for a statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $120 (waived for the first year)

By comparison, the Wealthsimple Visa Infinite* Card earns a flat 2% everywhere.

Whether you’re booking flights or buying bottled water in Europe, the simplicity and consistency can be hard to beat.

Conclusion

The Wealthsimple Visa Infinite* Card brings a refreshing simplicity to the Canadian credit card market, offering unlimited 2% cash back on all purchases and no foreign transaction fees, two features that are rarely seen together.

It’s a strong option for high spenders, frequent travellers, and anyone who wants to skip the mental math of bonus categories, caps, or rotating promotions.

With the recent addition of comprehensive insurance coverage — including emergency medical, trip interruption, and rental car protection — the card is starting to feel much more like a well-rounded product, rather than just a beta test.

Still, the lack of a welcome bonus and its limited availability via waitlist mean it’s not yet a must-have for everyone. And because it currently requires a Wealthsimple Chequing account for bill payments, it may not fit seamlessly into every wallet.

But for those already in the Wealthsimple ecosystem, or anyone who values predictability and premium simplicity, this card could be a game-changer — and it’ll be exciting to see how the newly launched Wealthsimple Visa Infinite Privilege* Card stacks up next.

† Terms and conditions apply. Please refer to Wealthsimple’s website for the most up-to-date product information.

English (US) ·

English (US) ·