As we enter 2025, the travel rewards landscape has shifted significantly. Banks have tightened their lending practices, loyalty programs have undergone further devaluations, and premium award availability has become increasingly scarce.

While these changes affect each traveler differently, here’s my strategy for navigating the evolving miles and points scene for my family in the year ahead.

Credit Card Strategy

1. Canadian market

Despite avoiding a recession, ongoing economic challenges have led banks to implement stricter lending criteria, making credit card approvals more selective. Financial institutions are increasingly prioritizing longterm customer relationships and moving away from exceedingly generous sign-up bonuses.

The trend is shifting toward rewards for sustained card usage through monthly spending requirements and loyalty bonuses for cardholders who maintain their accounts beyond the first year.

This means earning points quickly through just sign up bonuses will increasingly be a thing of the past.

I will be trimming down my Canadian credit card portfolio and keeping a select few cards I regularly use and that have good ongoing benefits that I know I can make use of.

The focus will be to strategically use cards that offer category multipliers for my everyday spend and leveraging shopping portals such as the Aeroplan eStore to enhance my points earning (especially during increased multiplier promotions).

Here are some of the key credit cards my husband and I plan to maintain in our household portfolio for the long run:

- Marriott Bonvoy American Express for its annual free night certificate

- National Bank World Elite® Mastercard® for its insurance coverage on award bookings and 2X recurring bill payments multiplier

- RBC Avion Visa Infinite Business card for its 1.25X base earning rate

- American Express Cobalt card for its 5X dining and grocery multiplier and 2X gas multiplier

- RBC ION+ Visa for its 3X grocery and dining multiplier for those places that don’t accept Amex

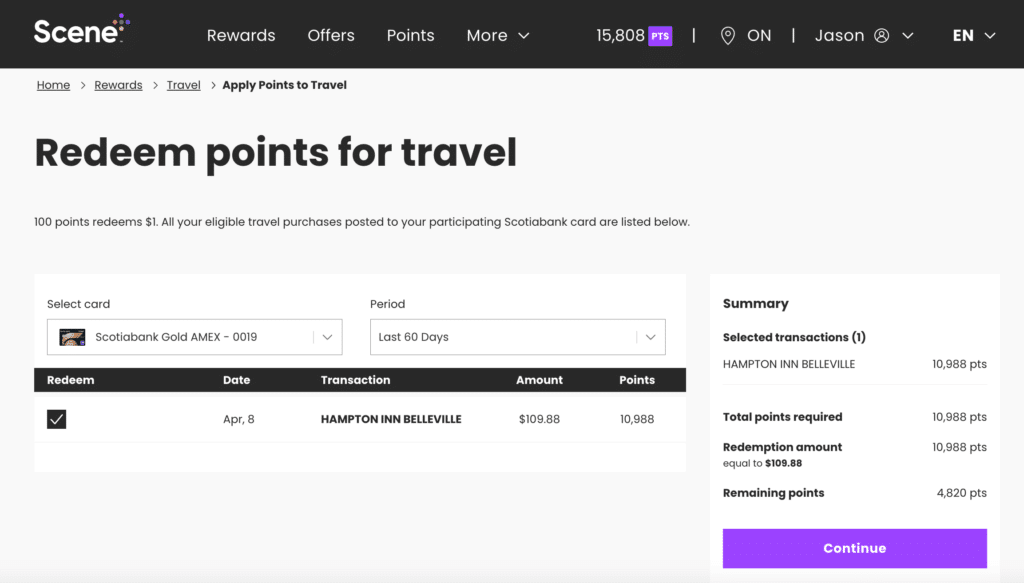

I’ll also be focussing more on fixed-value reward programs to offset my cash travel purchases. Specifically, programs like Scotiabank Scene+ points, CIBC Aventura points, and TD Rewards points to offset costs of flights, car rentals, and non-branded hotels at a fixed redemption rate. The flexibility in redeeming these currencies is key. For example, every 100 Scene+ points can be redeemed against $1 of travel purchases of my choosing.

2. US market

In the US, strong competition among numerous banks continues to generate generous welcome bonuses that can be earned with a single minimum spend requirement.

Additionally, US credit cards typically offer more attractive perks, such as no foreign exchange fees and various statement credit offers that can easily offset annual fees. They can also provide better earn rates on everyday spending compared to their Canadian counterparts.

For example, the Capital One Venture X Rewards Credit Card has a 2X base earning rate. Even after factoring the exchange rate, you’re still earning 1.5X points on every Canadian dollar of spend. Even better, the $300 (USD) annual travel credit and 10,000 miles anniversary bonus more than offset the $395 (USD) annual fee for the card.

If you haven’t branched out into the US market yet, make this the year to do it. For myself, I hope to get my first Citi card this year.

As I go over my flight and hotel award strategies, I’ll highlight some of the US Amex and Chase cards that I value.

Hotel Award Strategy

While Marriott remains a popular choice for my family, I’m expanding my hotel horizons this year.

I’m particularly eager to explore Small Luxury Hotels of the World (SLH) properties through their new Hilton partnership, as redeeming Hilton Free Night Certificates at some of these luxury hotels has offered outstanding value. I’ve already got the Nimb Hotel in Copenhagen booked for this summer.

As a Hilton Honors American Express Aspire Card cardholder, I automatically receive an annual Free Night Certificate and Hilton Diamond status – the program’s highest tier, offering perks like free breakfast and room upgrades at SLH properties. Since one night is typically insufficient to fully enjoy these luxury hotels, I also maintain the Hilton Honors American Express Surpass® Card, which provides an additional Free Night Certificate after meeting the $15,000 USD annual spending requirement.

Since I was also able to extend my Hyatt Globalist status for two additional years (a future post on this later), I’ll be taking the chance to explore some Hyatt properties this year.

I’ve really appreciated the value I’ve received from the World of Hyatt reward program this past year as a Globalist, in addition to their free breakfast for the whole family, waived parking fees on award stays, suite upgrade awards that can be applied prior to arrival, and Guest of Honor awards that can be gifted to family and friends.

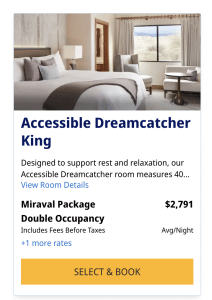

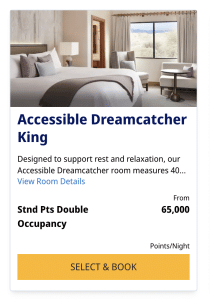

I’m particularly excited to try out my first Miraval all-inclusive resort later this year. The experience costs over $2,500 (USD) per night for a couple, but instead, I was able to redeem 65,000 World of Hyatt points per night for it earned through my Chase World of Hyatt Credit Card and my Chase Sapphire Preferred Credit Card. Chase cards are the only way to earn Hyatt points easily, so I won’t be parting with these cards any time soon.

Of course Marriott still has a place in our travels this year. We have the Walt Disney World Swan Reserve, an Autograph Collection hotel, booked for our upcoming trip. You can’t beat its location right beside Epcot and Hollywood Studios.

Since my husband has achieved Lifetime Platinum Elite status with Marriott Bonvoy, we don’t feel the pressure to stay with the brand. However, I still aim to help him earn 50 elite nights so he can receive five Nightly Upgrade Awards as his Annual Choice Benefit. This goal is readily achievable since he already receives 40 elite nights automatically through his Marriott Bonvoy Brilliant® American Express® Card and US Marriott Bonvoy Business® American Express®.

I will maintain my Platinum Elite status with Marriott as well. Two statuses are better than one as my kids grow older which may necessitate a second room, or if we travel with extended family or friends, which we often do.

Flight Award Strategy

While I cherish memories like my Emirates First Class Extravaganza, my travel priorities have evolved with work and family commitments. This year, I’m focusing on more purposeful travel that maximizes time at destinations rather than in transit.

The last couple of years my redemptions were primarily with Aeroplan since I had access to free cancellations, a few priority rewards, and was able to make use of eUpgrades for my whole family.

Aeroplan remains a great currency to invest in as Canadians given its large global network and numerous Star Alliance partners, but with dynamic pricing, limited partner award space, and difficulty finding eUpgrade space on many international routes, it won’t be my only currency going forward.

WestJet remains a competitive player for my family’s North American travels with its companion voucher offered through the WestJet RBC® World Elite Mastercardǂ or when booked through Delta’s SkyMiles program which allows booking any available WestJet seat on many routes at reasonable fixed redemption rates.

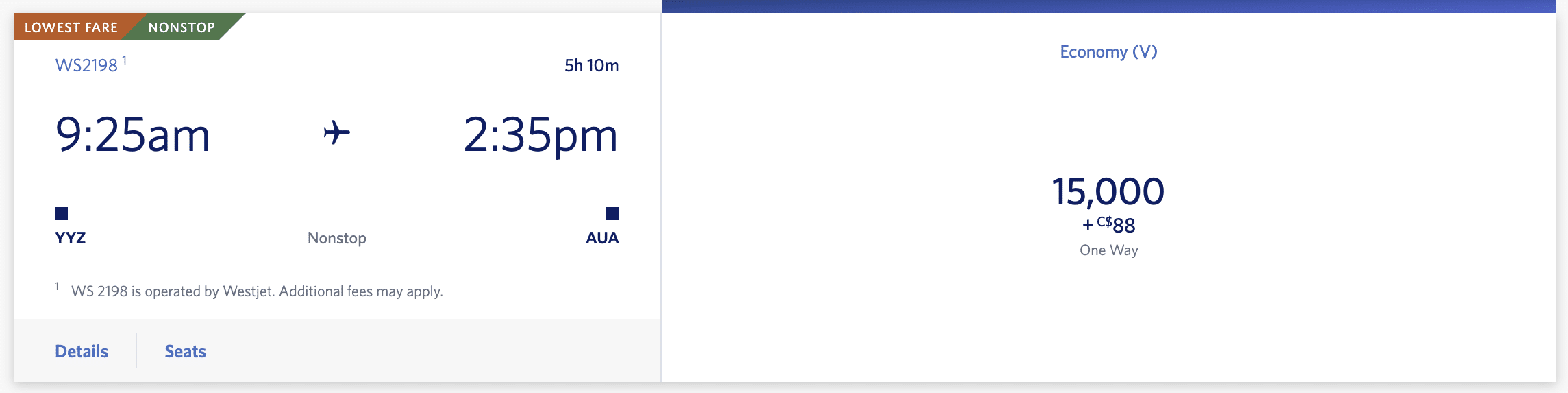

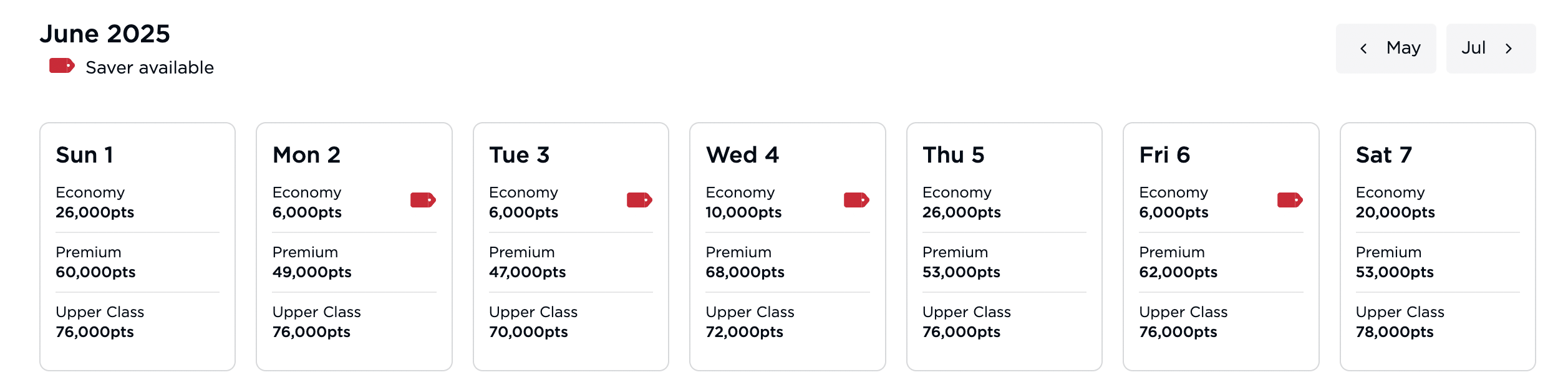

Flying Blue and Virgin Atlantic Flying Club are now my preferred programs to travel to Europe because of their decent award space and low saver award pricing. You can fly one way from Toronto to London for as low as 6,000 Flying Club points! Virgin Atlantic Flying Club is a transfer partner of several US banks, including US Amex, Chase, and Capital One.

Flying Blue redemptions cost more but have the added bonus of offering 25% off award redemptions for children aged 2 to 11 and running monthly promotions where redemptions on certain routes can be 25% off.

Diversification is essential, so I’ll focus on earning points in flexible currencies, allowing me to tap into various award programs depending on my travel plans and the best opportunities available.

While the Canadian credit cards do have a handful of airline and hotel transfer partners, US credit cards offer a lot more. Both Canadian and US credit card reward programs occasionally offer transfer bonuses to various partners, but these bonuses tend to occur more often in the US, helping your points go further in value. All the reason more to get your first US credit card.

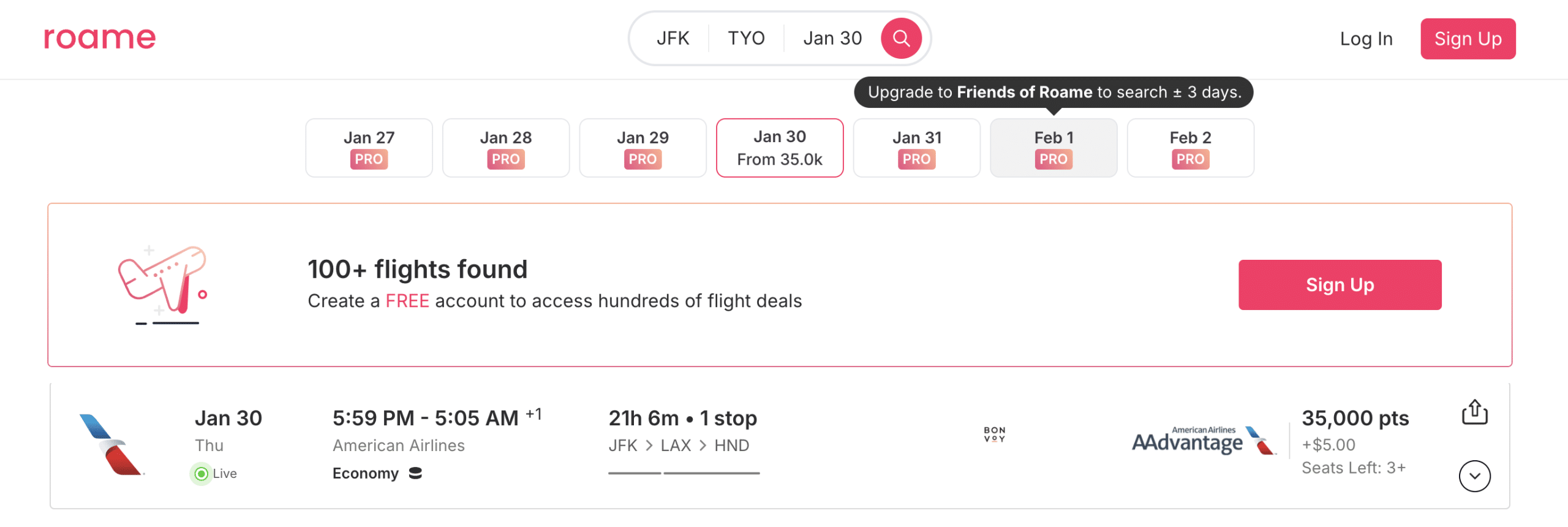

Lastly, while some award programs still have predictable patterns for releasing award space, others no longer do. If you find it challenging to keep track of which program to use for booking specific flights or when and where to search for award availability, consider using an award search tool like Roame.Travel or subscribing to a service like Straight To The Points. These tools and services do the heavy lifting for you, and the time saved can easily justify the subscription fee.

Conclusion

That’s my game plan for the year. I’ll continue earning points steadily on the Canadian side while diversifying my US portfolio and making the most of their benefits to lower my travel costs and enhance my travel experiences.

Got questions about your strategy? Join our Prince of Travel Membership Community, where our team and fellow like-minded members would be happy to discuss it with you.

English (US) ·

English (US) ·