The American Express Platinum Card® is one of the best premium travel rewards cards available.

American Express Platinum Card: Find out your offer — you may be eligible for as high as 175,000 Membership Rewards points after spending $8,000 on eligible purchases on your new card in your first six months of membership. Welcome offers vary, and you may not be eligible for an offer.

Its value comes not just from a big welcome bonus, but also from a long list of perks. When used strategically, these perks can easily offset its $895 annual fee (see rates and fees) and then some.

Here's how to get the most out of them.

Welcome offer

New Amex Platinum applicants can find out their offer and see if they are eligible to earn as high as 175,000 Membership Rewards points after spending $8,000 on purchases within the first six months of card membership. (Welcome offers vary, and you may not be eligible for an offer.)

That bonus is worth up to $3,500, according to TPG's October 2025 valuations.

To get the most out of the bonus, transfer points to airline and hotel partners for high-value redemptions. Short-haul flights on JetBlue start at 3,500 points, and a one-way ticket in Qatar Airways' Qsuite to Doha can be booked for 70,000 points. Keep an eye out for transfer bonuses, which can lower the number of points you need.

Related: Who should (and shouldn't) get the American Express Platinum?

Travel credits

Much of the card's value comes in the form of statement credits. Strategically using these credits can offset a significant portion of the Amex Platinum's annual fee.

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Hotel statement credit

The hotel credit is arguably the single most valuable credit on the card. You get up to $600 in total each year, split into two up-to-$300 credits across the first and second halves of the year, for prepaid stays booked through American Express Travel® at Fine Hotels + Resorts or The Hotel Collection properties (enrollment required).

Fine Hotels + Resorts bookings include daily breakfast for two, a $100 property credit, early check-in (when available) and a guaranteed 4 p.m. departure. The Hotel Collection requires a two-night minimum stay, but it can be a good way to book upscale properties at a lower cash rate.

To maximize this credit, focus on properties where the extras stretch your stay further. At times, promotions can offer an additional free night at select hotels, which can increase the value of your credit.

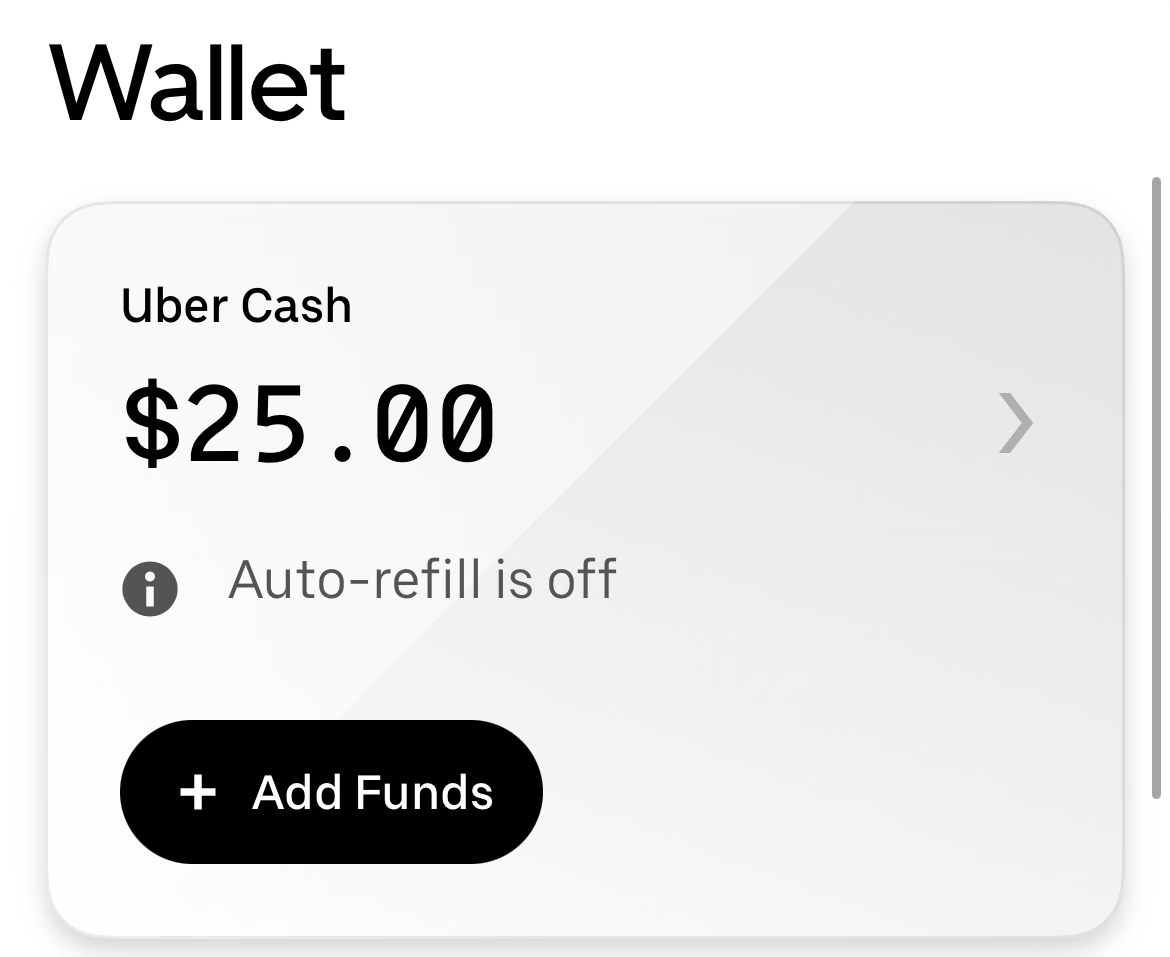

Uber Cash

You'll receive up to $15 in Uber Cash each month — plus an extra up to $20 in December — valid for rides or Uber Eats orders in the U.S. (enrollment required). Link your Platinum Card in the app so the credit applies automatically. (Uber Cash will only be deposited into one Uber account when you add the Amex Platinum as a payment method and redeem with any Amex card.)

If you are not in the U.S., you can use it to send a ride or meal to someone back home.

In addition, you can effectively get a complimentary Uber One membership, with an up-to-$120 statement credit that fully covers an automatically renewing $96 annual membership or $9.99 monthly membership (enrollment required). Perks include no delivery fees on food orders (minimum amount applies) and 6% back on rides.

Airline fee statement credit

Each year, the card provides up to $200 in credits toward incidental fees on one selected U.S. airline. This works best for checked bag fees, seat selection fees and onboard purchases (enrollment required).

I use mine to buy United Airlines TravelBank Cash in $50 increments, which can then be applied toward future flights.

Clear Plus statement credit

The card covers the cost of an annual Clear Plus membership (up to $209 per calendar year, subject to automatic renewal). This allows you to use dedicated lanes at airport security and skip the standard ID check.

You can maximize this perk by combining it with discounts to reduce the out-of-pocket cost of Clear Plus for multiple people. For example, any Delta SkyMiles and United MileagePlus member can enroll in Clear Plus for $199 (and it's even cheaper for those with elite status or cobranded credit cards). Then, you can add a family member for $125 and bring kids under 18 for free.

Global Entry/TSA PreCheck statement credit

Your card reimburses your application fee for Global Entry once every four years ($120) or TSA PreCheck once every 4 1/2 years (up to $85). Global Entry includes PreCheck, so it usually offers the better value.

Since authorized users also get their own credit, enrolling everyone in your household can save time at security and immigration.

Lifestyle credits

Fully using the following three credits on your Amex Platinum can save you hundreds of dollars a year on streaming and fitness purchases.

Digital entertainment statement credit

You'll get up to $25 in monthly statement credits for eligible subscriptions with the following providers:

- Disney+ and the Disney+ Bundle

- ESPN+

- Hulu

- Paramount+

- Peacock

- The New York Times

- The Wall Street Journal

- YouTube Premium and YouTube TV

You can stack multiple subscriptions to get the full $25 credit each month. For example, you might combine a streaming platform with a news subscription to unlock the entire up-to-$300 annual value. I personally use mine to cover my Disney+ Bundle and YouTube Premium subscriptions.

Oura Ring statement credit

You receive up to $200 annually toward eligible hardware purchases from Oura (enrollment required). Because it does not cover the monthly subscription, the credit is best used when upgrading or buying a new Oura Ring for yourself or as a gift.

Equinox and SoulCycle statement credits

The card offers up to $300 per year toward eligible Equinox memberships or a digital Equinox+ subscription (enrollment required; subject to automatic renewal). Using the credit for the $39.99 monthly digital plan is the simplest way to capture the full value.

You'll also receive up to $300 in statement credits each calendar year toward a SoulCycle At-Home Bike purchase through Equinox+. Note that you must be enrolled in an Equinox+ membership to be eligible for this benefit.

Shopping credits

The Amex Platinum also has its share of shopping credits, including some recently introduced in the refresh.

Lululemon statement credit

You'll receive up to $75 in statement credits per quarter for eligible purchases at U.S. Lululemon stores (excluding outlets) and lululemon.com (enrollment required). Any unused amount does not roll over.

To stretch this benefit further, consider stacking it with the Rakuten shopping portal to earn extra rewards; look out for at least 10% cash back being offered. You can also find strong value in the "We Made Too Much" sale section or explore secondhand options through the brand's resale program, allowing you to maximize the credit without overspending.

Related: 10 TPG-recommended items to buy with your $75 Amex Platinum Lululemon credit

Walmart+ statement credit

You'll receive up to $155 in statement credits annually when you pay for your monthly Walmart+ membership with your card (enrollment required; subject to automatic renewal). Since the standard cost is $12.95 monthly (plus tax), the credit effectively covers the full monthly fee (excluding Plus Ups).

Walmart+ offers perks like free grocery delivery (on orders of at least $35), free shipping (no minimum), fuel discounts, free home returns and free tire repair. You can also choose between an (ad-supported) Paramount+ Essential subscription (separate enrollment required) and a Peacock Premium subscription at no extra cost, and you can switch between the two every 90 days.

Saks Fifth Avenue statement credit

This perk is available in the form of two up-to-$50 statement credits each year (enrollment required). Your first statement credit can offset purchases from January through June, and the second is available from July through December.

There is no minimum purchase required to trigger these statement credits, so you could make a purchase of $50 (or less) once every six months and not owe anything out of pocket once the credit posts to your Amex Platinum account. Avoid the $9.95 shipping fee by purchasing in-store or meeting Saks' free shipping threshold ($300 at the time of writing).

Related: Why the new Amex Platinum changes are converting me to a cardmember

Dining statement credit

You'll receive up to $100 in statement credits each quarter when paying with your Platinum Card at participating U.S. restaurants affiliated with Resy (enrollment required). No reservation is required; simply pay with your card at an eligible restaurant.

Some cardholders (including me) have also triggered the credit by buying gift cards from Resy-affiliated restaurants (though results may vary). Useyourcredits.com lists which ones typically work for gift card purchases.

Keep in mind that the Platinum Card earns just 1 point per dollar spent at restaurants, so this perk is best viewed as a statement credit benefit rather than a points-earning opportunity.

Lounge access

One of the Platinum Card's most valuable perks for eligible cardmembers is entry to the American Express Global Lounge Collection, which includes more than 1,700 lounges across 140-plus countries. This covers Centurion and Priority Pass lounges (enrollment required) as well as Delta Sky Clubs (when flying Delta Air Lines; limited to 10 annual visits), giving travelers broad coverage worldwide.

Centurion Lounges offer some of the best experiences, with premium food, drinks, showers and comfortable spaces, making them ideal for longer layovers. If you spend $75,000 or more on the card in a calendar year, you'll unlock complimentary guest access to Centurion Lounges, which can add significant value for frequent travelers.

To get the most value, be sure to enroll in Priority Pass, check entry rules ahead of time and plan your lounge visits strategically. Be aware of access limits and time restrictions, especially at Delta Sky Clubs, which enforce capacity controls and guest fees.

Elite status

With the Amex Platinum, you'll get automatic elite status with a combined six hotel and car rental programs (enrollment required). These benefits can enhance stays and rentals with upgrades, bonus points and priority service.

Hotel elite status

You'll receive the following status levels:

- Hilton Honors Gold includes an 80% points bonus, daily breakfast (or an on-property credit at U.S. hotels) and room upgrades (when available).

- Marriott Bonvoy Gold Elite offers a 25% points bonus, enhanced room upgrades and premium internet.

- The Leading Hotels of the World Leaders Club Sterling offers daily breakfast for two and five prearrival upgrades annually.

Car rental elite status

You'll also receive the following status tiers:

- Avis Preferred Plus

- Hertz Gold Plus Rewards President's Circle

- National Car Rental Emerald Club Executive

Registering for these programs is a quick win, even if you don't travel often. Hotel elite status can unlock perks like complimentary breakfast and upgrades, while car rental status can help you skip the counter, secure upgrades and improve your odds of getting the vehicle you want during busy travel periods.

Bottom line

The Amex Platinum is not designed for everyday spending.

Rather, its value comes from knowing how to maximize its benefits. If you align your travel and lifestyle spending to match the card's credits and perks, it is possible to get far more value than the annual fee.

The key is to plan ahead, enroll in every benefit you qualify for and use the statement credits strategically throughout the year.

To learn more about the card, read our full review of the Amex Platinum.

Apply here: American Express Platinum Card

For rates and fees of the Amex Platinum Card, click here.

English (US) ·

English (US) ·